TL/DR –

The IRS has spent around $1.95 billion, or 2.5%, of the nearly $80 billion it will receive from the Inflation Reduction Act, as of June 30, according to a report from the Treasury Inspector General of Tax Administration (TIGTA). The majority of the funds have been used towards the pay and benefits of IRS employees, as well as to pay contractors for advisory and assistance services. Alongside its $12.3 billion fiscal year 2023 annual appropriation, the IRS had received approximately $79.4 billion in supplemental funding over 10 years, but $1.4 billion of this was rescinded by lawmakers and another $20 billion will be cut and repurposed.

IRS Spends $1.95 Billion of Inflation Reduction Act Funds

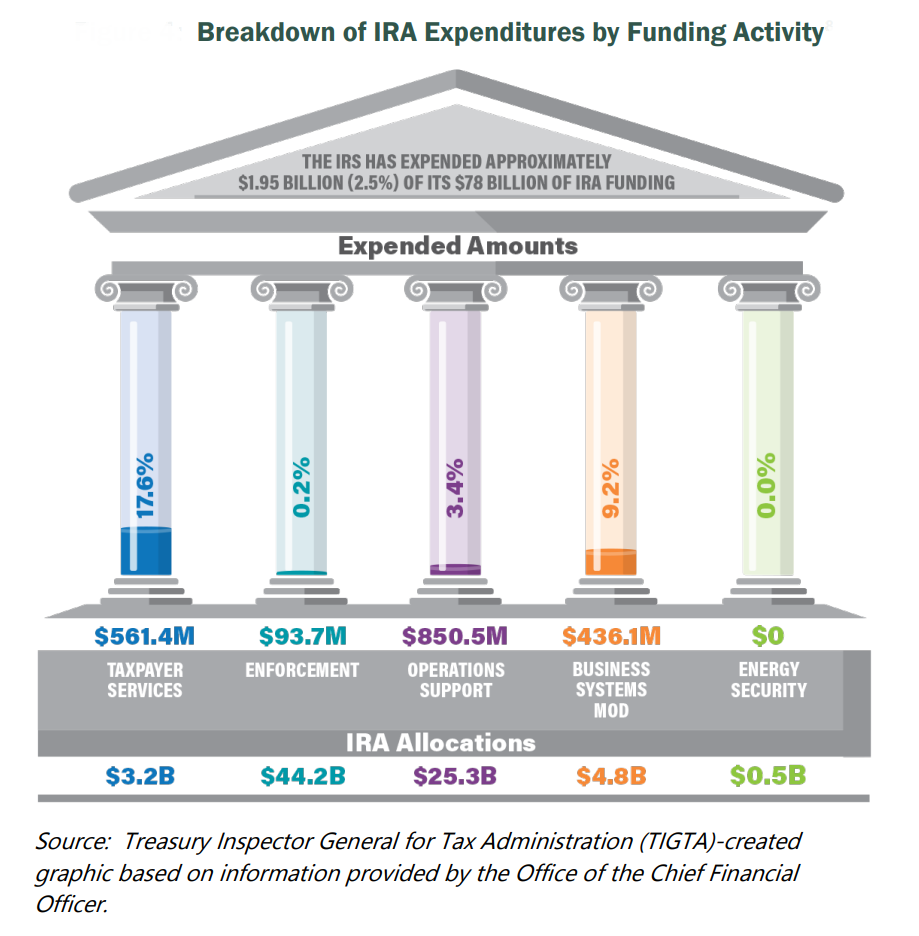

As of June 30, the IRS has utilized roughly $1.95 billion, or 2.5%, of the near $80 billion it will receive due to the Inflation Reduction Act, revealed by a recent report from the Treasury Inspector General of Tax Administration (TIGTA).

TIGTA’s review provides insights into the IRS’s usage and accounting of Inflation Reduction Act funds. The IRS watchdog aims to offer this sort of report on a quarterly basis.

So far, the majority of the spent money went towards IRS employees’ salaries, benefits, and contractor payments for advisory and assistance services. Operations support and business systems modernization expenditures amounted to around $299 million and $337 million, respectively, TIGTA noted.

Along with its fiscal year 2023 annual appropriation of $12.3 billion, the IRS obtained roughly $79.4 billion of supplemental funding over a decade when the Inflation Reduction Act was enacted in August 2022, TIGTA said. Amid debt ceiling talks this summer, lawmakers rescinded around $1.4 billion of that funding. An extra $20 billion is expected to be trimmed and repurposed following the agreement last June between Biden and ex-House Speaker Kevin McCarthy to suspend the debt limit and cap federal agency expenditure, according to IRS officials.

IRS officials explained to TIGTA that nearly $2 billion of Inflation Reduction Act funding has been allocated to supplement its FY 2023 annual appropriation. The amount the IRS received didn’t include adjustments for inflation, estimated at around $460 million from FY 2022, TIGTA mentioned.

As per the report, IRS employee compensation, totaling around $721 million, and contractor advisory and assistance services, totaling about $720 million, comprised the largest portion of Inflation Reduction Act expenditures as of June 30.

Most labor costs ($497 million) were within taxpayer services, TIGTA reported. This includes the IRS hiring extra customer service representatives and employees to staff taxpayer assistance centers for the 2023 filing season, aiming to enhance the taxpayer experience.

TIGTA added that the IRS will face significant challenges in increasing its staffing levels to 105,188. The IRS predicts it could lose 26,000 employees due to retirement or separation from FY 2023 to FY 2025. Consequently, to meet its recruitment goal, the IRS needs to onboard over 52,000 employees during FY 2023 to FY 2025 to keep pace with estimated attrition, TIGTA noted.

Read More US Economic News

Comments are closed.